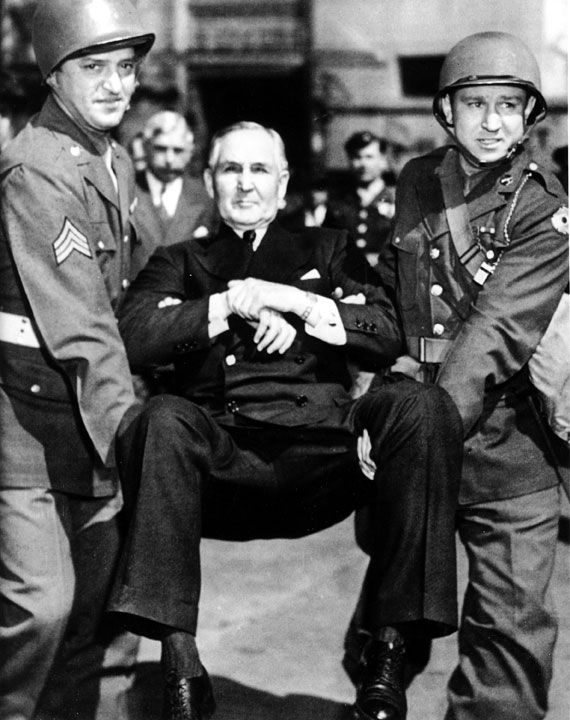

Sewell Avery, chairman of Montgomery Ward:

the last businessman to tell the government, "Fuck you."

Arrested in 1944 for defying Franklin Roosevelt's executive order.

the last businessman to tell the government, "Fuck you."

Arrested in 1944 for defying Franklin Roosevelt's executive order.

"Siemens to shed US jobs over wind tax credits threat," says the Financial Times.

Siemens is set to cut more than 600 wind power jobs in the US in response to regulatory uncertainty over the future of wind tax credits that has buffeted the renewables industry and threatens thousands of jobs. ...Maybe you have to be over a certain age to find anything strange about this. Little by little, we've become accustomed to industries, businesses, and jobs that depend on what the federal government will buy or subsidize. We're slouching toward state capitalism.

Local politicians blamed Congress for holding up a renewal of the tax credit.

That, however, is a theme for our other blog, Reflecting Light. The subject of Ghost Money is investing.

There's a lesson here for investors: don't imagine you can simply hitch a ride on the federal government's latest fad. While the Fall of the House of Wind probably won't even scratch the paint on Siemens, a huge international company, that isn't necessarily the case for smaller companies engaged in -- for instance -- green energy, in response to Washington's calculated vote buying. The same will apply to next year's purple energy.

Maybe you think you can time your play so you're there when the dollars that formerly belonged to taxpayers fall from the ceiling, and be out of there when the rain has passed. Perhaps that's no greater risk than many others you can be exposed to in the markets. But you'd better be nimble.

The government giveth. And the government taketh away.

Keywords: [Siemens] [wind power] [government subsidies]

Ghost Money's author does not claim to know what he's talking about. He is not an investment advisor. This site is for entertainment, if it can even manage that.